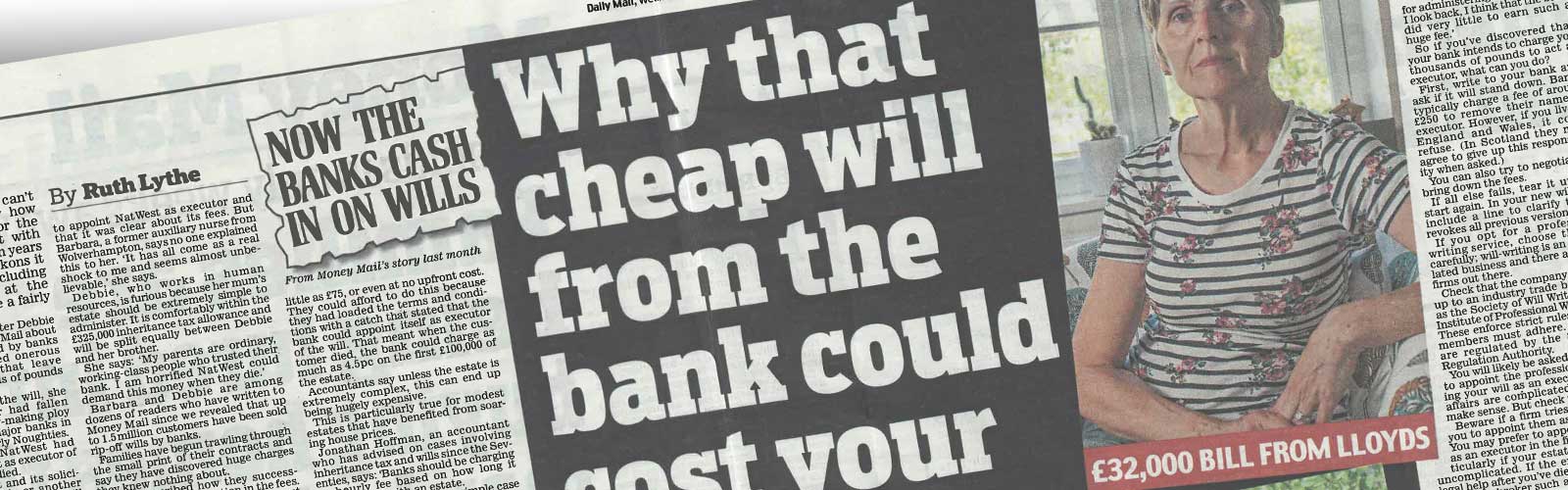

Why that cheap will from the bank could cost your family £30,000

As victims of yet another banking scandal speak out, what to do if you were taken in too…

Barbara Morey can’t remember exactly how much she paid for the will she took out with NatWest about ten years ago. The 78-year-old reckons it was roughly £140, including storage, and thought at the time that it seemed like a fairly good deal. But last month her daughter Debbie Folkes read an article in the Mail about how some of the wills sold by banks such as NatWest included onerous terms and conditions that leave grieving families thousands of pounds out of pocket. When Debbie dug out the will, she discovered her mother had fallen victim to a major money-making ploy used by nearly all the major banks in the late Nineties and early Noughties.

In the small print, NatWest had reserved the right to act as executor of the will when Barbara died. That means NatWest and its solicitors, rather than Debbie or another family member or trusted friend, will be responsible for wrapping up her estate and dealing with everything from property sales to inheritance tax. In return for this service, the bank states it will charge a £1,500 administration fee and a whopping 2.5pc of her mum’s total estate (plus VAT). The estate is currently worth around £220,000 – so this works out at £7,000 plus VAT.

The bank claims that Barbara chose to appoint NatWest as executor and that it was clear about its fees. But Barbara, a former auxiliary nurse from Wolverhampton, says no one explained this to her. ‘It has all come as a real shock to me and seems almost unbelievable,’ she says. Debbie, who works in human resources, is furious because her mum’s estate should be extremely simple to administer. It is comfortably within the £325,000 inheritance tax allowance and will be split equally between Debbie and her brother. She says: ‘My parents are ordinary, working-class people who trusted their. bank. I am horrified NatWest could demand this money when they die.’

Barbara and Debbie are among dozens of readers who have written to Money Mail since we revealed that up to 1.5million customers have been sold rip-off wills by banks.

Families have begun trawling through the small print of their contracts and say they have discovered huge charges they knew nothing about. Some described how they successfully begged for a reduction in the fees. One man managed to get the fee cut from £14,000 to £6,000 after challenging his parents’ bank. Another family faced a £32,000 bill to administer their mother’s estate, only for the bank to refuse to help when the will was challenged by a relative.

Around the turn of the millennium, many major banks offered wills for as little as £75, or even at no upfront upfront cost.cost. They could afford to do this because they had loaded the terms and conditions with a catch that stated that the bank could appoint itself as executor of the will. That meant when the customer died, the bank could charge as much as 4.5pc on the first £100,000 of the estate.

Accountants say unless the estate is extremely complex, this can end up being hugely expensive. This is particularly true for modest estates that have benefited from soaring house prices. Jonathan Hoffman, an accountant who has advised on cases involving inheritance tax and wills since the Seventies, says: ‘Banks should be charging an hourly fee based on how long it takes to deal with an estate. ‘There is no reason why a simple case involving passing an estate between a husband and wife should be any more than ten hours of work. Even charged at £200 an hour this should amount to no more than £2,000.’ Some banks have reduced these fees in recent years – but they are still high. Lloyds, for example, charges 2.5pc on the first £1 million of an estate. On a £500,000 estate this works out at £12,500. NatWest charges 2.5 pc up to a maximum of £15,000 plus a £1,500 administration fee.

A NatWest spokesman says: ‘We offer upfront and transparent fees which are capped at a maximum amount. Where an estate is simple to administer we will look to offer a discount or, if appropriate, we will also offer the option for the bank to renounce: The bank is not automatically appointed as executor and customers are free to appoint a different executor at any time.’

The first Graham Penfold knew about these fees was when a smartly-dressed woman knocked on his mum’s door a few days after his dad, Dennis, died 11 years ago. Graham and his wife Janice were staying at his family home in London to help his mum Margaret, then 79, plan the funeral and sort out his father’s affairs. The woman said she had been sent by HSBC to discuss Dennis’s will. Graham says she explained that the bank had been named as an executor and planned to charge £14,000 to administer the estate. The Penfolds were astounded by the figure, as Dennis’s affairs were incredibly simple.

He had been offered a free will by HSBC in the early Noughties as an employee perk when he worked in the print department at the bank. In it, he had stated that everything would just pass to his wife, Margaret. Their £360,000 three bedroom house in Whetstone, North London, was already in both of their names and the £30,000 they had in savings was in a joint bank account. Graham, a former electrical engineer from Milton Keynes, asked the woman how the bank could justify charging £14,000 for so little work.

He says the woman then stepped out of the lounge and into the hall to make a phone call. When she returned, she said she could reduce the bill to around £6,000. The family accepted this and paid a total of £6,563 including VAT and legal advice fees. More than a decade later Graham, 66, says he still feels let down by the whole process. ‘Mum and Dad had been married for 56 years. She was in shock after he died and so vulnerable,’ he say: ‘Dad really believed that free will meant a free will when, in fact, it was nothing of the sort.

I’m so angry for them. ‘My parents were of the generation where they didn’t make a fuss. Had Mum, who has since died, been alone when the woman arrived, I really worry she’d have ended up paying the full £14,000.’

A HSBC spokesman says: ‘We are sorry to hear that Mr Penfold has now raised concerns about elements of how his father’s will was administered over a decade ago. We did not receive any complaints at the time or since. ‘We no longer provide a service and executor, but when Mr Penfold [senior] used HSBC’s will-writing service he was able to choose the executor and he chose HSBC.’

When Sheena Hayes’s’ aunt, Martha Mathers, died in 2008, Lloyds took £32,000 from her estate in charges for acting as an executor. Martha had died aged 81 without children, so left her estate – worth just under £1million – to eight nieces and nephews. But in the small print of her will, Lloyds reserved the right to charge 4pc on the first £500,000, 3pc on the next £500,000 and 1.5pc on the remainder. Yet, despite the hefty charges, when a member of Martha’s extended family challenged the will Lloyds said it could not help as its fee did not include legal advice in the event of disputes between beneficiaries. This meant that the family had to hire their own solicitor and pay a further £18,000 in legal costs.

Sheena, 61, from Bideford, Devon, says there is no way her aunt, who was deaf, could have realised the full extent of the fees; ‘I think my aunt would have been horrified if she had understood the true cost of administering her will,’ she says. ‘Banks should highlight that the charges for doing so do not include legal fees.’ A Lloyds Bank spokesman says it reimbursed the family for some of the solicitor’s fees they incurred because of the challenging of the will. He says: ‘We’re sorry for Ms Hayes’s loss of her aunt and the challenges she has had dealing with the estate. Family disputes, particularly involving larger estates, can be complex and occasionally result in additional legal issues which are not covered by standard fees. In this case, caveats were raised by family members which we tried to resolve with minimal legal costs. However, we were forced to seek specialist legal advice to resolve the situation.

Another reader says her elderly friend’s £310,000 estate was charged £16,000 by a bank to deal with matters after she died in 2008. This was on top of £4,406 paid to solicitors who handled the property sale. The reader also says she was told to contact the utility companies herself, along with sorting out other aspects of her friend’s affairs. She adds that she had no idea about the fees until she received the documents back from the bank around a year later. She says: ‘At the time I just assumed that it was the typical charge for administering a will. But now I look back, I think that the bank did very little to earn such a huge fee.’

So if you’ve discovered that your bank intends to charge you thousands of pounds to act as executor, what can you do?

First, write to your bank and ask if it will stand down. Banks typically charge a fee of around £250 to remove their name as executor. However, if you live in England and Wales, it could refuse. (In Scotland they must agree to give up this responsibility when asked.) You can also try to negotiate to bring down the fees. If all else fails, tear it up and start again; In your new will, just include a line to clarify that it revokes all previous versions.

If you opt for a professional writing service, choose the firm carefully; will-writing is an unregulated business and there are rogue firms out there. Check that the company is signed up to an industry trade body, such as the Society of Will Writers or the Institute of Professional Will Writers. These enforce strict rules to which members must adhere. Solicitors are regulated by the Solicitors’ Regulation Authority. You will likely be asked if you want to appoint the professional arranging your will as an executor. If your affairs are complicated, this could make sense. But check the fees. Beware if a firm tries to persuade you to appoint them as an executor. You may prefer to appoint a relative as an executor in the first place, particularly if your estate is relatively uncomplicated.

If the executor needs legal help after you’ve died, they can ask a probate broker such as Final Duties, which should provide a flat fee to deal with the estate. Even if your estate is more complex and you prefer a professional executor, then wherever possible – try to include a relative as executor too. They will understand your wishes better than a firm of solicitors.

Most banks, including ZEDRA (which has taken over the Barclays probate business) and the Co-operative (which runs the former HSBC wills business), claim they will lower fees if an estate is very simple. NatWest says the same. So hold them to their word.

Experts say as a rule of thumb that it should cost no more than £4,000 to administer a simple estate where no inheritance tax is due, savings are held in cash and there is a single property to be divided between your children. If an estate like this is being passed to your spouse, the fee should be even less. Higher charges may be justified if inheritance tax is due on the estate or if it includes stock market shares, which can take time to sell.

If you or a loved one has already paid charges to the bank from the estate, you’re unlikely to get your money back even if you believe the terms were unfair. However, it is still worth complaining to the bank. Lay out the fees and explain why you believe your loved one’s estate was overcharged.

If you do not get a satisfactory response, take your complaint to the Financial Ombudsman Service. You can make a complaint six years from the event or three years from the time that you knew (or could have reasonably known) you had cause to complain.

Even if your loved one died long ago, it may be possible to argue that you realised that the fees were excessive only after reading about the issue in Money Mail this year.

Article by Ruth Lythe, Dally Mall, Wednesday 18 July, 2018.

Find out more about our Wills and Trusts services or contact us now.